With strong consumer spending and AI investment in stark contrast to a contracting labor market, the US economy is currently giving out wildly divergent signals.

In a recent research, Morgan Stanley Chief Economist Seth Carpenter pointed out that the market is at a crucial juncture and that the final outcome of these “conflicting signals” will dictate the destiny of asset prices.

Data on consumer expenditures suggests that the economy is still strong, with third-quarter consumption growth around 3%; nevertheless, there are also growing indications of labor market deterioration.

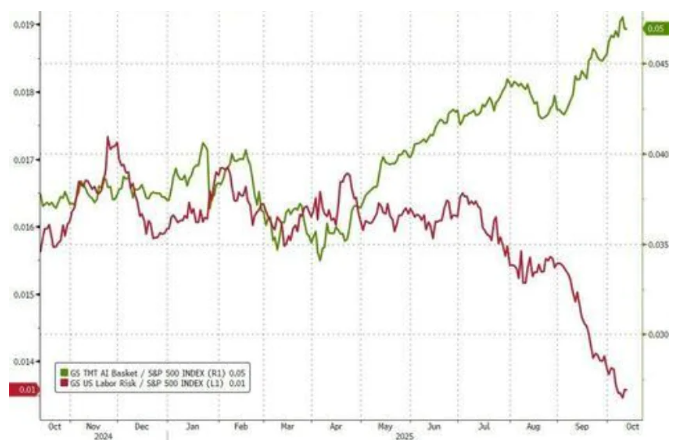

This discrepancy is further supported by recent study from Goldman Sachs. The bank noted that two major themes in the US stock market have not changed much: the AI stock basket (GSTMTAIP) has performed well due to the continuous advancement of artificial intelligence, while the labor-sensitive basket (GSXULABR) has underperformed due to ongoing labor market concerns.

Resilience in AI Investment and Consumer Spending

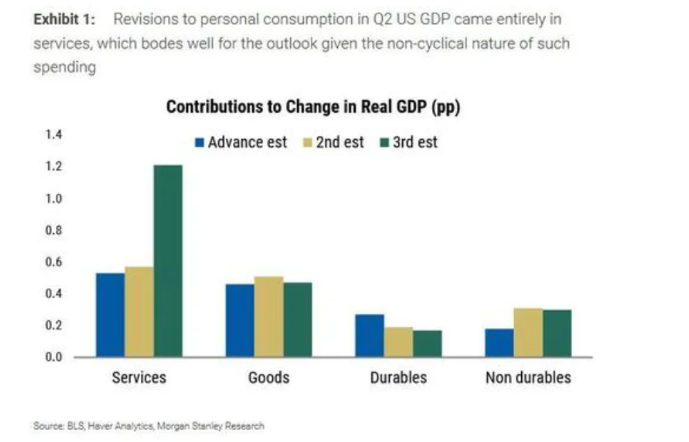

expenditure ultimately determines economic development, according to data from Morgan Stanley, and the most recent expenditure statistics demonstrate a stable and even strong economy. Despite being somewhat outdated, the second-quarter GDP statistics indicated a recovery in household services expenditure, and the third-quarter consumption growth was close to 3% based on the data that was available.

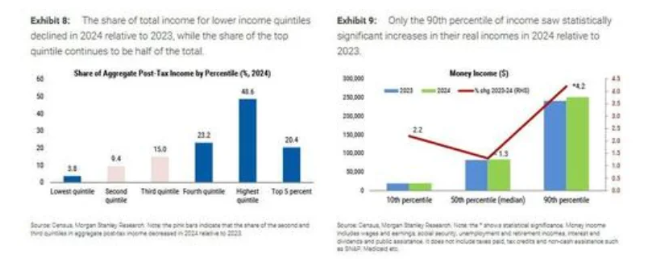

Carpenter noted that although wealth has increased dramatically in recent years, households with high incomes and wealth make up a disproportionately big amount of all consumption expenditures.

Spending by consumers is important, but so are capital expenditures associated with AI. Since they represent a multi-year investing theme, these investments are comparatively insensitive to short-term cyclical changes.

There are indications that the labor market is weakening

But there is equally strong evidence of a slowdown in the economy. Morgan Stanley’s analysis indicates that this year has seen a noticeable slowdown in job creation. Immigration restrictions have slowed the growth of the labor force, but the increase in unemployment in the absence of wage pressures points to an equally significant fall in labor demand.

As a result, labor income growth has slowed and, after accounting for inflation in the previous quarter, has remained flat or even negative in real terms. Carpenter observed that a large portion of consumption spending has been focused on automobiles, primarily due to front-loaded purchases brought on by pre-tariff stockpiling and electric car tax subsidies. The upcoming months should witness a reduction in these high expenses.

In terms of the impact of tariffs, the 2018–19 experience demonstrates that tariffs had a significant detrimental impact on domestic manufacturing in the United States that lasted for over a year, with a lag of almost two quarters before the drag started.

Michael Gapen, an analyst at Morgan Stanley, recently pointed out that data indicates that tariffs imposed thus far essentially function as a production tax.

There are substantial differences in the Fed’s policy trajectory

The policy trajectories for the Federal Reserve under the two scenarios diverge significantly. Economic resilience or accelerated growth requires a conservative policy approach, leaving little leeway for further rate decreases, given that inflation has been over the goal for more than four years and unemployment is near its estimate of full employment.

On the other hand, larger rate cuts will be required than are now priced into the interest-rate market if the economy slows down considerably, with unemployment rising and growth nearing stagnation.

The market has exaggerated the possibility of rate reduction if the economy is strong, and corporate earnings may not be as positive as anticipated if the economy is bad, Carpenter said. An average of all potential outcomes can occasionally be the most accurate forecast.