Hopes of an interest-rate decrease have been reignited, and the Australian currency has plummeted due to the worst unemployment rate in four years.

Following a surge in unemployment, investors anticipate a November interest-rate cut, which has caused Australia’s currency to plummet while the sharemarket soars.

According to new data from the Australian Bureau of Statistics, 34,000 Australians lost their jobs in September, while 15,000 persons found new employment.

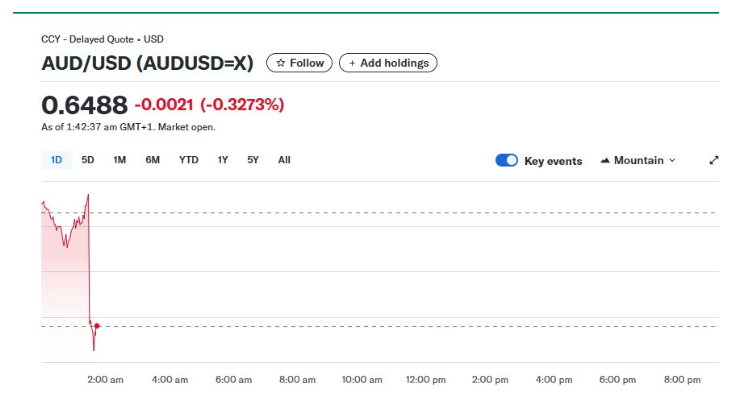

The Australian dollar fell 0.5% versus the US dollar to 64.85 US cents following the announcement.

In the meantime, the yield on three-year bonds fell 12 basis points to 3.36 percent.

This indicates that when the Reserve Bank meets again on Melbourne Cup day, money markets are increasing their wager that it will lower interest rates.

Because the number of jobs produced did not equal the number of potential employees, the unemployment rate unexpectedly increased when the participation rate rose to 67%.

Currently, the participation percentage is barely around 67.2%, which was a record high.

Brendan Rynne, chief economist at KPMG, stated that the RBA should be concerned about Thursday’s numbers.

“The RBA should aim to lower the cash rate to a more accommodative level at its next meeting in order to support business investment and household spending, both of which should support the labor market,” he stated.

Anders Magnusson, chief economist at the BDO, thinks the RBA will remain calm at the next meeting despite the September spike in unemployment.

“The release today demonstrates that the labor market is continuing to cool gradually, which keeps the RBA on track instead of pushing its hand,” he said.

Mr. Magnusson acknowledged that the market was now expecting more rate cuts.

“After this data release, market expectations, as inferred from ASX traded futures, will probably shift further in that direction,” he added, hinting to a rate drop rather than a hold at the RBA’s November meeting.

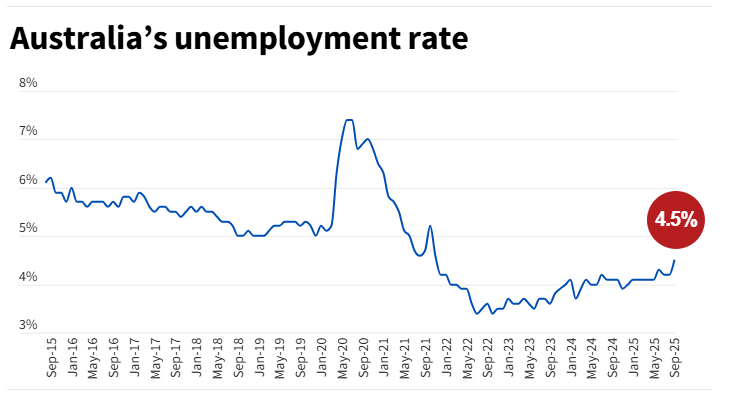

As a result, the overall unemployment rate increased from a revised 4.3% in August to 4.5% in September.

According to ABS data, Victoria has the highest unemployment rate at 4.7%, which is 0.3% higher than August’s estimate. South Australia comes in second with 4.5%. Rates in other jurisdictions are 4.2% or 4.3%.

Male unemployment increased by 24,000 to 370,000, while female unemployment increased by 10,000 to 314,000.

Due to a 23,000 increase in full-time employed men and a 15,000 decrease in full-time working women, full-time employment increased by 9000.

Economists had predicted a 20,000 rise in employment but a 4.3% unemployment rate prior to Thursday’s data.

The central bank, which has the dual responsibility of maintaining inflation and employment stability, relies heavily on the unemployment rate.

In the past, RBA governor Michele Bullock stated that employment was rather “tight,” meaning there were more jobs than workers.

“Spending binge”

The Albanese government has been under fire from the opposition for the most recent job statistics, claiming that Labor’s spending binge is destroying the economy.

“Everyday Australians bear the consequences of Labor’s expenditures,” stated shadow treasurer Ted O’Brien.

“Inflation stays sticky when government expenditure spirals out of control, forcing the RBA to maintain higher rates for longer.

“Michele Bullock is pressing the brake, and Jim Chalmers is pressing the accelerator.”

Tim Wilson, a spokesman for employment and industrial relations, claimed that the government was putting itself in an unsustainable loop of taking on more debt in order to boost job creation.

According to Mr. Wilson, “these unemployment figures come despite analysis showing eight out of ten jobs are being created by public spending and nine out of ten in Victoria.”

“This government’s only way to combat rising unemployment is to borrow more money and spend more of it, which will raise inflation and interest rates for all Australians.”