The summer, wage growth in the UK slowed a little as unemployment increased somewhat.

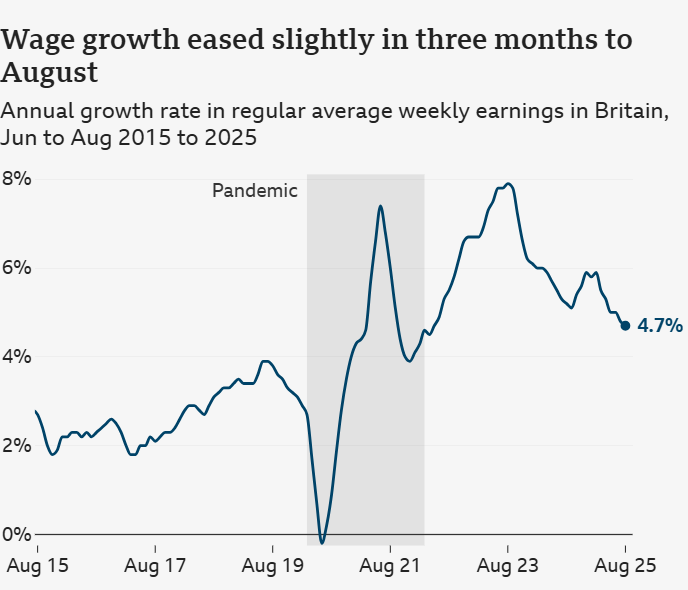

New data from the Office for National Statistics (ONS) shows that average salary growth decreased from 4.8% in the three months to July to 4.7% in the three months to August.

From 4.7% to 4.8%, the national unemployment rate increased little.

After a year of turbulence, analysts said the figures showed that the UK labor market was stabilizing.

In the three months leading up to September, job openings decreased by 9,000, or 1.3%, according to the ONS. This was the 39th consecutive period in which job openings decreased in comparison to the preceding three months.

“After a long period of weak hiring activity, there are signs that the falls we have seen in both payroll numbers and vacancies are now levelling off,” stated Liz McKeown, director of economic statistics for the ONS.

Youth are the main cause of unemployment.

The ONS was observing distinct trends across age groups, according to Ms. McKeown, who also stated that “the increase in unemployment was driven mostly by younger people.”

The number of people who were economically inactive due to being retired or students decreased every three months, but this was mostly countered by an increase in economic inactivity due to other factors, such as chronic illness.

The statistics were painting “a clearer picture of a labor market that’s soft, with younger workers facing the biggest challenges,” according to Danni Hewson, head of financial analysis at AJ Bell.

The decision to increase employer national insurance by Chancellor Rachel Reeves, she claimed, “made it more expensive for employers who had lots of part-time staff, many of them being younger workers dipping their toe in the labor market for the first time.”

“The fact the ONS has found that the rise in unemployment in the three months to August was driven mostly by younger people suggests those warnings have become reality,” said Ms Hewson.

“Making it harder to find these types of jobs could have a marked impact on their relationship with work in the future.”

The ONS is taking further action to resolve concerns regarding the quality of the data and has stated that the unemployment rate should be handled carefully.

Stable job market

The public sector saw 6% annual salary increase, while the private sector saw 4.4%.

Despite being the lowest in four years, private sector earnings growth outpaced inflation.

According to the ONS, some public sector pay increases that are paid earlier in 2025 than in 2024 have an impact on the public sector’s annual growth rate.

Finding a job is becoming more difficult every month, according to Sarah Coles, head of personal finance at Hargreaves Lansdown. In contrast, wages for those who are employed are currently increasing just slightly faster than inflation.

Although employers have blamed their reduction in new recruits on rising national insurance, Ms. Coles said it was difficult to determine the exact impact on the labor market.

“It’s not all bad news.” By historical measures, unemployment is still low at this point, and the employment rate has even somewhat increased in the last 12 months.

However, the data shows “a fairly steady labor market,” according to Chris Hare, senior UK economist at HSBC, who spoke on BBC Radio’s Today program.

“I think we’re probably seeing fairly soft demand for labour in the economy,” he stated, predicting that it will result in “a gradual easing in broader cost pressures in the labour market and an easing in wage growth” .

Between June and August 2025, there were 3.8 layoffs for every 1,000 employees, which is more than the figure during the same period the previous year.

Additionally, the ONS increased the prior wage growth estimate from 4.7% to 4.8%.

The state pension rise for the following year will probably be determined using this amount.

The state pension is raised by the greater of inflation, wage growth, or 2.5% under the triple lock policy.

“Paltry” rise in real wages

With inflation at 3.8% right now, real pay growth—the amount that workers are better off with after taking increases in the cost of living into account—was 0.9%.

The Liberal Democrats responded to the data by claiming that real wage growth is hardly keeping pace with inflation.

Real weekly salaries have only climbed by £1.50 since last September, according to the Resolution Foundation, which also called real pay growth “paltry” and “barely enough to cover the cost of a Greggs sausage roll.”

According to Charlie McCurdy, an economist at the think tank, “cost of living pressures are likely to build over the autumn due to the deteriorating labor market and persistently high inflation.”